(Editor’s Note: This is the first part in a two-day series on the proposed nickel tax for Christian County Public Schools.)

A week from today, Christian County voters will be asked to declare if they support or oppose a nickel tax that could help pay to construct two new high schools within a decade.

The result of the election will determine whether the public school system can raise enough money to first replace Hopkinsville High School and then Christian County High School.

It is arguably one of the most significant proposals in recent history affecting the school system, the overall community and local taxpayers, and the decision might rest with a relatively small number of the county’s residents. Christian County’s voter turnout has been among the lowest in the state for several years. In last year’s general election, only 33 percent of eligible voters cast a ballot.

However, intense campaigns by opponents and supporters of the nickel tax could boost turnout in this election. For some voters, the school funding issue is more likely to get them to the polls than the ballot’s statewide offices, including the governor’s race between incumbent Republican Matt Bevin and Democratic challenger Andy Beshear.

‘There is no time to wait’

“When you weigh everything — the leaking roofs, the crowded cafeterias, the lack of proper science labs … there is no time to wait,” said Stephanie Harton, a physical therapist who works for the school system and supports the nickel tax.

Harton disagrees with opponents who believe the high schools can be renovated rather than replaced. That would be like taking a flip phone and trying to install an upgrade that would magically create an iPhone, she said.

Concerns over school district spending

Mark Graham, who lost an election bid to serve on the school board last year and now leads the group Citizens for the Right to Vote on Tax Increases, has challenged the tax proposal with a range of questions about the district’s spending habits. The group has made several complaints on its Facebook page about fiscal management by school officials, including complaints that the district spends too much on hotel rooms for conferences. District officials have countered that conference expenses are often tied to grants.

“… We want the best for our kids and we would LOVE to see a new, state of the art school in our community,” Graham and his wife, Angie Graham, posted last weekend on the group’s Facebook page. “But had the (Christian County school system) been more financially responsible, we could have one WITHOUT raising taxes. That is what our campaign is about.”

Putting the question to voters

“It’s time to go beyond patchwork. We need to make a bold commitment to replace these academic buildings,” Christian County Public Schools Superintendent Mary Ann Gemmill said at a Feb. 21 school board meeting, according to the Kentucky New Era.

Subsequently, the five school board members — Linda Keller, Tom Bell, Jeff Moore, Susan Hayes and Lindsey Clark — voted unanimously for the addition of a nickel tax to the county’s school property tax.

Opponents of the nickel tax then collected enough signatures of registered voters on a petition seeking to recall the school board’s action. State law requires the signatures of at least 10 percent of the total number of voters who cast a ballot in the previous presidential election in the county — which was 22,260 in Christian County in 2016.

The county clerk’s office verified the petition from the group opposing the tax. As a result, voters who go to the polls on Nov. 5 will see this question on their ballot:

“Are you for or against the Christian County Board of Education levying an additional equivalent tax rate of five cents on each $100 of real and personal property to raise funds to be used only for major renovation of existing school facilities, new construction, and debt service on that construction or renovation?”

District officials say both high schools would require multi-million dollar renovations — for repairs and to bring the schools up to date for current technology and security needs. Hopkinsville High, which was completed in 1963, is generally considered in worse shape than Christian County High, which was completed in 1969.

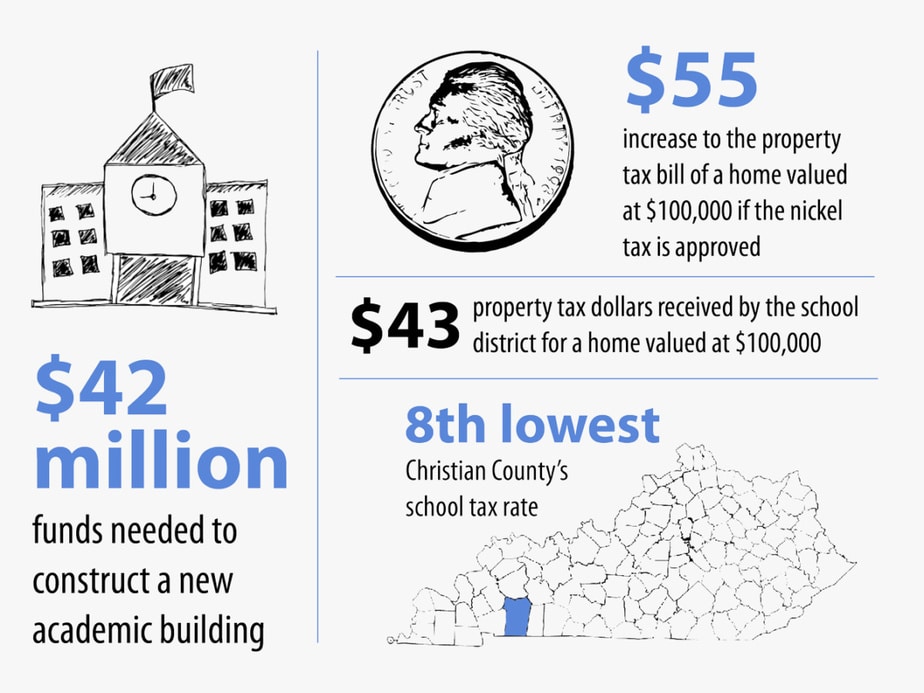

State education regulations prevent districts from investing in renovation work that would cost 80 percent or more of new construction. That’s the case at HHS, where renovations and upgrades to the academic building would cost $38 million and new construction would be $42 million, the district estimates.

Opponents argue the renovation plan is extravagant. They prefer a general sprucing up rather than construction of a modern facility.

How the tax affects property owners

A nickel tax has been adopted by 107 Kentucky counties, said Christian County school board attorney Jack Lackey.

Under state law, a nickel tax can be used only for new construction or maintenance of existing school property. The tax is 5.5 cents per $100 of assessed property value. That means a home valued at $100,000 would have an additional $55 on the tax bill annually. The nickel tax is in addition to the school district’s current property tax rate of 42.8 cents per $100 of assessed real property.

At 42.8 cents, Christian County’s school tax rate ties with Cumberland County for the eighth-lowest rate among Kentucky’s 120 counties. Pike County has the state’s highest county school tax rate at 88.7 cents.

Some property owners get a break on their property taxes. Kentucky’s homestead act for people 65 and older, and for disabled property owners, exempts $39,300 from the tax. Also, farmland is taxed below its assessed value.

The district’s bonding capacity

The school district’s current bonding capacity — or the amount it could finance for new construction — is approximately $15.7 million. That is not even half the amount needed for one high school.

The proposed new academic building, at $42 million, would be constructed on the current campus and the gymnasium and other athletic facilities would not be replaced. An extremely ambitious scenario projects the new school could be built by 2022.

The nickel tax would boost the school system’s bonding capacity to $51.8 million, and state bonuses tied to a local nickel tax — called equalization money — would push the bonding capacity to $61 million, according to the pro-nickel tax group’s website and district officials.

Lackey, the school board attorney, and Graham, who heads up the group that opposes the tax, disagree on the likelihood of that additional $10 million in state equalization money.

Over the weekend, on the Facebook page for the Citizens Right to Vote on Tax Increases, Graham posted a link to a measure adopted by the Kentucky General Assembly in 2018 that he interprets to mean equalization funds will not be approved for Christian County.

“It just so happens there is a law in Kentucky that prevents any money from ‘Equalizing’ any local school district levying an equivalent tax rate subject to recall,” he wrote.

Lackey countered in a statement provided to Hoptown Chronicle: “While it is true that the 2018 budget resolution contained a precatory statement of intent against equalization going forward, that language is not binding and it is not a law that would have to be changed or that would prevent the General Assembly from providing equalization funding for the Nickel in an upcoming budget resolution. Budget resolutions are created from scratch every two years. Equalization funding is provided at the discretion of the General Assembly every two years when the General Assembly formulates its budget.”

Following construction of a new academic building at HHS, the district would have paid off the debt for the new Christian County Middle School in 2025. That would free up money to construct a new academic building for Christian County High School around 2027, Lackey said. The district could raze the old middle school and build the new high school there, he added.

Lackey conceded the dates he provided — HHS by 2022 and CCHS by 2027 — are ambitious. Both projects still need design work, which involves a detailed approval process with the local school board and state education officials.

(Coming Wednesday: How the two sides are campaigning for votes and some of the conflicts and missteps that have occurred leading up to Election Day. Plus, resources for voters.)

(This story was edited to include the correct date Christian County High School was constructed.)

Jennifer P. Brown is co-founder, publisher and editor of Hoptown Chronicle. You can reach her at editor@hoptownchronicle.org. Brown was a reporter and editor at the Kentucky New Era, where she worked for 30 years. She is a co-chair of the national advisory board to the Institute for Rural Journalism and Community Issues, governing board past president for the Kentucky Historical Society, and co-founder of the Kentucky Open Government Coalition. She serves on the Hopkinsville History Foundation's board.