As members of Congress push for allowing payday lenders to access federal loans, data show that their business in Kentucky dropped precipitously when the pandemic struck.

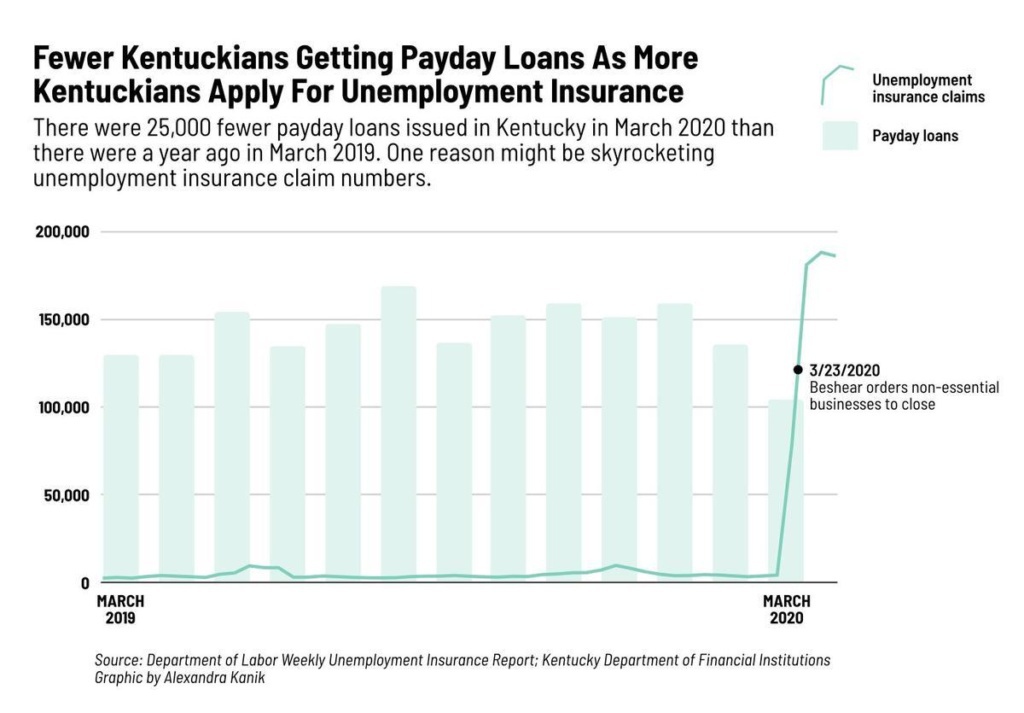

The industry processed about 20% fewer loans in March than it did the previous March, according to a monthly report provided to the Kentucky Department of Financial Institutions by the loan processing firm Veritec Solutions. That represents a drop in lending of $8.3 million in the short-term, typically high-interest loans.

The database shows loan volume ranged from 129,000 in March 2019 to as high as 168,000 loans the following August. But only 104,000 loans were processed this March, the lowest by far in the last year.

More than 282,000 Kentuckians filed for unemployment insurance in March.

Payday, or deferred deposit, loan products offer small-dollar loans to borrowers, typically those with poor credit or without access to a traditional bank account. Data show the average payday loan in the last year in Kentucky was $348. Borrowers usually need to pay back the amount borrowed, plus interest and loan fees, within two weeks’ time.

Critics of the industry say the loans are designed to trap borrowers into a cycle of debt, and research from the Consumer Financial Protection Bureau shows that more than 75% of payday loan fees come from people who borrow more than 10 times in a year.

The industry turned to Congress for help to manage the downturn, and a group of lawmakers asked Treasury Secretary Steven Mnuchin and Small Business Administration head Jovita Carranza last week to allow short-term, high-interest lenders to access funding from the Paycheck Protection Program.

No decline in business was mentioned in the letter; Kentucky Rep. Andy Barr, a Republican from Lexington, was among those who signed it.

If granted, the lawmakers’ request would allow payday lenders offering annual interest rates as high as 469% to tap into forgivable loans with a 1% interest rate.

Ben Carter of the Kentucky Equal Justice Center says it’s too soon to tell why loan volume has decreased in Kentucky.

Expanded unemployment benefits may be reaching more people and helping the newly unemployed cover living expenses; Kentucky’s halt on evictions may mean people are less desperate for immediate cash even after a job loss.

The real impact of the coronavirus and subsequent policy changes won’t be clear until months down the road, Carter said, and people may still turn to these products as the crisis lingers.

“The reality is that payday loans are incredibly expensive,” Carter said.

Payday loans already on decline

Interest rates are capped at 36 percent or lower in 16 states and the District of Columbia. But lenders in Kentucky are not subject to a rate cap, though borrowers can only have two outstanding loans from a lender at a time.

Consumers have been shifting away from payday or deferred deposit loans, according to Whitney Barkley-Denney, senior policy counsel at the Center for Responsible Lending, a nonprofit research and policy group affiliated with the Self Help Credit Union.

Instead, borrowers have been turning more and more to installment and online lenders, some of which offer longer repayment plans with more forgiving interest rates than payday lenders.

The Kentucky Department of Financial Institutions issued guidance on March 24 for non-bank lenders to “work with customers affected by the coronavirus to meet their financial needs.” The department recommended lenders restructure existing loans, extend repayment terms or waive fees.

So far, small, non-bank financial institutions have not been eligible for Paycheck Protection Program loans. That includes federally certified Community Development Financial Institutions, which provide financing options with interest rates comparable to banks to underserved communities under strict guidelines. The lawmakers specifically sought in their letter to include those institutions.

Not mentioned in the letter are payday lenders. But Rep. Blaine Luetkemeyer, a Republican from Missouri and one of the letter’s principal authors, confirmed to POLITICO that it was meant to cover payday lenders. Luetkeymeyer is a member of the House Financial Services Committee and one of the payday loan industry’s favorite lawmakers, having received $164,900 from the industry over his career, according to OpenSecrets.

Payday lenders have contributed more than $50,000 to Barr’s congressional campaigns, according to Open Secrets. Barr’s electoral opponents in the 6th District representing central and northeast Kentucky have previously criticized his relationship to payday lenders.

Barr’s office did not respond to a request for comment.

“Keeping individuals who work at non-PPP financing providers employed during these difficult times will facilitate restoring America’s productivity as soon as the health crisis dissipates,” the letter reads.

The Community Financial Services Association of America, a trade group representing payday lenders that are active in Kentucky such as Advance America and CheckSmart Financial, says that its members are essential businesses providing access to credit.

“Including these businesses in the Paycheck Protection Program would ensure lenders, many of which are small businesses, are able to keep credit flowing, serving their customers and communities without interruption,” a spokesperson for the Community Financial Services Association of America said in an emailed statement.

Critics say payday loans don’t match PPP goals

Barkley-Denney of the Center for Responsible Lending, however, says that most payday lenders are not small businesses, and that allowing them access to taxpayer funds through the Paycheck Protection Program “would be the opposite of what the PPP is supposed to do.”

“The PPP is about building wealth in communities,” Barkley-Denney said. “Payday lenders are the opposite of that; they strip wealth from communities, they make people less financially secure. So the idea that we’d want to spend taxpayer dollars propping them up is just absurd.”

Sarah Crozier, the Senior Communications Manager at the Main Street Alliance, a network of small business owners, says gaps in the Paycheck Protection Program prevent it from truly helping many small businesses. Main Street Alliance has heard from members that the program’s timeline for aid is too short and too limited in the expenses it covers. Many small businesses have had trouble getting approval from lenders while larger companies have received loans before the initial funds ran out.

But opening up the program to high-interest lenders, including to companies that provide predatory loans to small businesses, would be a step in the wrong direction, says Crozier.

The lawmakers’ letter also sought to cover companies offering factoring services or merchant cash advances, which tap into a business’s future income to secure funds. Recent research from the Opportunity Fund, a nonprofit small business lender, found such products carry an average annual interest rate of 94 percent but can climb as high as 358 percent.

“To open up the small business funding to payday lenders who go and turnaround and abuse small businesses, is absolutely the wrong way to go about supporting the small businesses during the crisis,” Crozier said.